We’re seeing a big increase in financial fraud these days. You’d think with everyone watching out for sketchy crypto gurus or weird text messages, we’d be safe. But weirdly enough, the fact that we now suspect everything might be a scam is actually a big reason why financial fraud is hitting an all-time high. Someone even mentioned losing most of their life savings in a dating scam – tough stuff.

You might be trying to save money and “tighten the belt” this year, but there are a few types of scams really growing right now. Dating scams, where tricksters convince people to put money into fake crypto investments, are one example. But in 2023, these scams got way more complicated than you might guess.

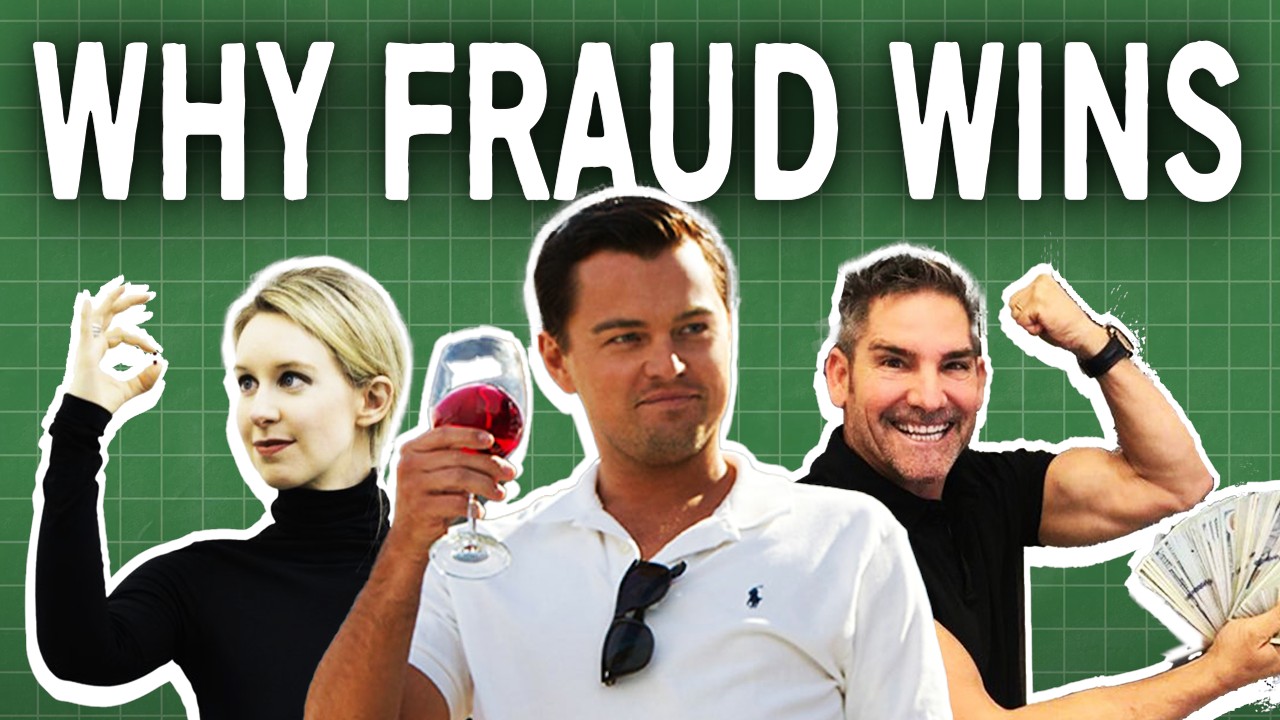

Society, believe it or not, has a strange fascination with con artists. Think about it: we’re all talking about Sam Bankman-Fried getting convicted for ripping off millions of investors. But the same crypto fans who lost money when FTX crashed probably at some point cheered on the wealth and flashy life of the Wolf of Wall Street, who was also a convicted fraudster who stole a ton from investors. It’s kinda wild to think that in 40 years, those super annoying “hustle bros” might be putting inspirational quotes over pictures of SBF. It sounds funny, but this sort of thing totally happens.

Fraud in the World of Venture Capital

Okay, let’s switch gears a bit and talk about the big money world. A reporter named Aaron Griffith at the New York Times wrote about hundreds of fake companies being created. These companies had fake business plans and even fake users, all just to attract investment money from venture capital firms.

Firms like Sequoia, Andreessen Horowitz (A16z), and Accel had so much money that they couldn’t invest in new ideas fast enough. So, they started encouraging founders to maybe “fudge their numbers a bit” to get those huge, life-changing investments.

Some companies took that money and actually built real businesses. But others just had to keep lying as more and more investors jumped in. If you were a company founder trying to be completely honest about your business, you’d find it way harder to even get a meeting with these investors because you were up against other founders who weren’t scared to stretch the truth or just flat-out lie to say what investors wanted to hear.

The venture capital firms lived by that “growth at all costs” idea you hear about in Silicon Valley. They didn’t really seem to care because even if the companies they invested in never made a profit, they could pump them up enough to sell them to other big companies or just dump their shares onto regular people through a SPAC.

Here are a couple of examples:

- Charlie Javis faked millions of users on her app called Frank. She still managed to sell it to JP Morgan for a whopping $75 million.

- Abraham Shafi had an app called IRL that claimed millions of daily users. It raised 1 billion. But later, an investigation by its own board found that 95% of its users were completely fake.

Just from these two fake apps alone, that’s a total of $325 million that could have gone into real startups.

This shows that fraud can happen at the highest levels. But while big companies are getting tricked by founders who might wear strange clothes, that’s actually not where most fraud is happening. Most fraud is aimed at everyday people. And even if they don’t make any silly mistakes themselves, passing the cost of scams onto regular folks has become more profitable than ever because of a couple of other worrying trends.

While those fancy investors eventually figured out the risks of skipping due diligence (checking things out properly), and the hype is finally calming down from funding things like “Uber for office kombucha taps,” the bigger issue is the impact on regular folks. The “Paradox of the Grift,” you could call it – where people suspect everything except the actual scams. This hurts normal people who don’t have the time or money to thoroughly check out every offer they get.

The people getting hit hardest by these smaller scams aren’t who you might expect. The most common victim of financial fraud isn’t actually older folks with memory issues being targeted by IRS scam calls. According to data from the FTC (Federal Trade Commission), those scams do trick millions every year, and yes, more needs to be done to help those at risk. It’s frustrating that you have to check every single email, text, and phone call for weird links, and it’s tiring. But with a bit of care, you can usually avoid those.

But the fastest-growing type of financial fraud is much tougher to protect yourself from. To explain why, we need to talk about… influencers.

Why Fraud Thrives: The Five Big Reasons

Okay, let’s get into why fraud seems to win out over honesty almost every time.

Reason 1: Nobody Bothers Checking Anymore

Even though people are more aware of fraud than ever, a big problem is that folks just don’t check things carefully anymore. Good, honest companies and people are often held back by rules and trying to be truthful. But scammers can just lie about how amazing their business is.

The reason they can get away with this for so long today is that fewer people are actually verifying their claims. Even big government groups like the Securities and Exchange Commission (SEC), the Federal Deposit Insurance Corporation (FDIC), and the Federal Trade Commission (FTC) have said themselves they don’t have enough staff or money to regulate everything happening in the markets.

According to the SEC’s enforcement results from 2022, they are now mostly relying on people reporting issues (whistleblowers) to go after things like pump-and-dump schemes (hyping up a stock/crypto to sell it quickly), messing with securities prices, and trading based on secret information.

You might know government regulators are short on funds, but even the private companies that are supposed to be smart investors failed too. Companies like FTX, Theranos, and WeWork all raised billions of dollars from experienced investors who did very little checking (due diligence) to confirm the wild claims made by the founders.

Low interest rates (money was cheap to borrow), the hype around venture capital investing, and the rise of SPACs meant there was a lot of investor money looking for the next big thing. Founders, especially the quirky ones, could practically pick and choose which investors they wanted, because investors were desperate to get their money into whatever company was creating the most buzz. And guess what? The companies that could create the most buzz were the ones that could just lie about doing something that would change the world – if only it were true!

From my own time working as an investment banker, specifically in healthcare, I saw how less flashy companies that were honest about their realistic goals got buried in mountains of detailed checking by experienced private equity investors. Meanwhile, companies making crazy claims about changing the medical world were easily approved by venture capitalists who thought they were much smarter than they really were.

Reason 2: Fraud is Exciting, Reality is Depressing

Let’s talk about influencers again. Wanting fame and money isn’t new, and people selling get-rich-quick schemes on late-night TV isn’t new either. But technology and culture have combined these things.

Back in the day (trying not to sound too old here!), celebrities were scared of being called “sellouts.” They had to be really careful about promoting stuff, or their fans would turn against them. Today, “selling out” is practically the goal! Modern celebrities and influencers are praised for launching new products and go on interviews where they talk a lot about how much money they make.

Look, there’s nothing wrong with celebrities making money, and some influencer businesses sell great things. But many don’t, and many get much worse.

According to a 2021 survey by the FTC about how consumers lost money to scams, 61% of all scam attempts started on social media and websites. Things like email, online ads, phone calls, and text messages were all fighting for the rest. This means the people you watch and trust online are, by a wide margin, the most likely source of a scam attempt.

Influencers know their fame won’t last forever. People’s tastes change, their audience grows up, or they might get into trouble and get kicked off their platform – that’s just show business. But the problem for this new generation of celebrities is that the wild stuff they put online themselves might make it impossible for them to get a normal job later. So, they feel they need to make enough money in their few famous years to keep up their fancy lifestyle forever. It’s possible to do this honestly, but it’s much, much easier to do it by jumping on the latest trends. If you’re an influencer and know your audience will eventually get bored anyway, it’s really tempting to make as much money as possible from them on the way out.

And that brings us to the second reason: Fraud is just more exciting than reality. Imagine you have $10,000 to invest. Are you putting it in a safe, broad market exchange-traded fund from someone like BlackRock, or in a crypto token pitched by a YouTuber? I really hope you know the right answer!

On other parts of the internet, you’ll see people hyping up super risky investments to young, easily influenced audiences, making video thumbnails with laser eyes saying things like BlackRock secretly runs the world. One of the biggest business and finance influencers, Patrick Bet-David, has made countless videos warning about big companies like Vanguard, BlackRock, and State Street, while also defending multi-level marketing (MLM) and network marketing, including his own MLM life insurance company. BlackRock isn’t perfect, but your money will almost certainly be safer with them than with the average influencer.

My friend Richard over at The Plain Bagel made a great video explaining that investing won’t make you instantly rich; it mainly helps you build wealth slowly by accelerating careful saving. But that’s… well, it’s boring. That kind of honest content doesn’t make as much money or get as many views on the algorithm as flashy displays of wealth and claims about making money that aren’t really compliant with rules.

Even influencers not selling get-rich-quick stuff feel like they need to make everything sound incredibly exciting to get views. I know I pick on Graham Stephan sometimes, but based on his video thumbnails, you’d think this guy has gone bankrupt four times just this year! Influencers are an easy target, and I get it – as a full-time YouTuber myself now, it’s tempting to use those flashy titles and images. But it all adds up to a culture of trying to get as much attention as fast as possible, and then turning that attention into cash.

The biggest issue? There seem to be very few consequences for doing this. People like Logan Paul, who heavily promoted several crypto pump-and-dump schemes when crypto was huge, hasn’t faced any real problems from regulators (who are also struggling to keep up). He hasn’t even taken much of a hit to his reputation and still has millions of fans watching his videos and buying things like Prime energy drinks.

Another friend, Patrick Boyle, talked with Zeke Fox, an investigative reporter for Bloomberg and the author of a book called “Number Go Up.” They discussed how “the grift” (scamming/tricking people for money) isn’t something people are ashamed of anymore. It’s now seen as high-status because the most visibly wealthy and high-status people seem to be doing it. Fox even said that trying to investigate this stuff feels pointless now because the people doing this kind of fraud are so open and unashamed about it. An investigative journalist doing a big story on a silly, obvious scam would be like a food critic writing a review of Taco Bell – it’s just too obvious and lowbrow to be a serious expose.

Reason 3: Fraud Moves Faster Than We Do

New technologies like cryptocurrencies, AI, and the internet itself definitely have real, useful purposes. But it can take years for people to truly figure out what those uses are and even longer to build actual businesses around them.

So, it’s not surprising that these new technologies are a golden chance for fraud. By claiming to have secret knowledge about how to use something new to make tons of money, tricksters can use the natural excitement about technology nobody fully understands yet to sell guides on how to profit from it. The “hustle bros” who were selling crypto trading courses when Bitcoin became popular are now telling you how to use Chat GPT to make millions by automating some kind of online business that sounds vaguely legitimate.

This problem isn’t just for people selling online courses; it affects everyone in finance. The venture capital funds that were throwing investor money at blockchain companies are now throwing it at anything that claims to use AI. And the influencers who used to be “crypto experts” now suddenly know how to use Chat GPT to make $300 a day. The speed of new technologies that people are desperate to understand is driving the speed of new frauds claiming to have the answers.

Reason 4: People Are Desperate

The reason people are so desperate for these quick answers is also the fourth reason they are so willing to convince themselves that a scam isn’t a scam. People are desperate.

I don’t need to say much about this one, but here are some points:

- According to Lending Club data, 62% of Americans are living paycheck to paycheck.

- Nobody earning minimum wage can afford to rent a basic two-bedroom apartment anywhere in the country.

- People often have to go through up to 17 interviews just to get one job.

- Interest rates are going up.

- Basic things you need cost twice as much as they did just five years ago.

- Most people feel like there’s no hope of things changing.

- The housing crisis in the United States is very real, and buying a home is incredibly hard for many people.

- Sadly, 4 out of 10 consumers feel worse off financially than they did last year.

When people are in a situation with no clear way out, anything that promises a solution looks good to them.

Reason 5: The Outlets We Trusted Switched to Sensationalism

The fifth reason why we now feel like everything might be a scam (besides the actual scams) is because the news sources and other places that were supposed to keep us informed have also decided they can make more money by being overly dramatic and sensational.

If you want to learn more about how this happened, check out the video “The 200-Year Decline of Journalism” on the “How History Works” channel.

Learn More

Speaking of learning, I’m going to be writing a full article looking at fraud culture in finance from the perspective of someone who used to work as an investment banker. If you want to catch that, plus other articles I write and great content from some of the best finance creators out there, make sure you sign up for my completely free email newsletter. You can find the link in the description below. It’s a good way to keep learning how money really works.